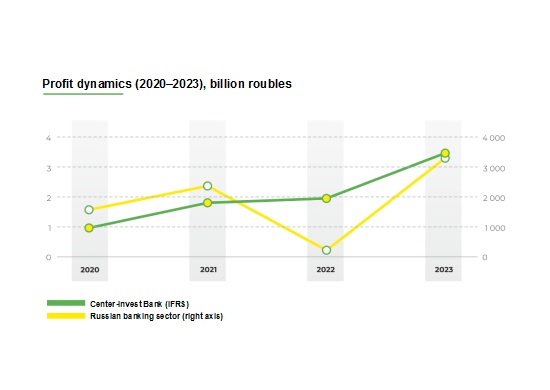

The profit of Center-invest Bank has grown 3.5 times over the past three years. According to the Bank of Russia, the profits of all Russian banks increased twofold.

We should take into consideration that the impressive performance of Russian banks in 2023 reflects recovering growth after a severe downturn in the previous year, following the principle «drop down — push up» and also include some easing under Russian accounting standards. Center-invest Bank’s solid financial performance under more stringent international standards is not subject to volatility. ESG business model of Center-invest Bank clearly demonstrates the maintenance of stable profit dynamics in any crisis situation.

«Profit is the main success criterion, despite all the assurances about the humanism of business, consideration of environmental, social and governance requirements. It is sustainable profitability that allows the bank to fulfil its voluntary commitments to implement social projects and make a significant contribution to the development of the region’s economy,» comments Chairman of the Board of Directors of Center-invest Bank, Professor, Doctor of Economics Vasily Vysokov.

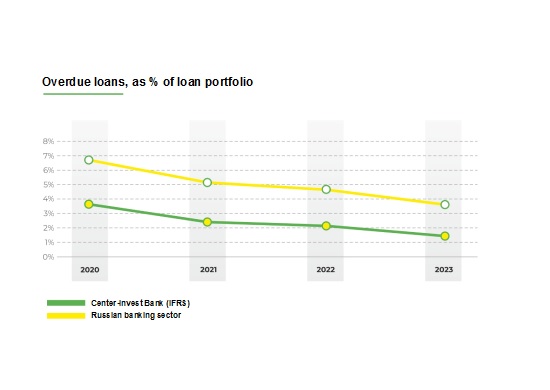

The benefits of sustainable ESG-banking are most evident in a crisis as they demonstrate a different principle of customer service. Speculative banks sell and buy risks. In a crisis, risks increase and speculative banks raise lending rates. The customers are forced to go into riskier projects, which increases the risks of banks’ default and losses.

During the crisis, Center-invest Bank manages risks together with the customers, jointly developing and implementing a programme of risk mitigation measures, and raising the quality of loans rather than rates. Customers get a competitive advantage, repay the loan on time and in full, which allows the bank to demonstrate sustainable profit growth and reduce bad debts. It is a win-win* strategy: both the customer and the bank win.

Center-invest Bank profit growth of 3.5 times compared to the market (2 times).

The share of Center-invest Bank’s overdue debt decreased by 2.5 times.

* win-win strategy — focus on the interests of all partners. This principle makes it possible to build long-term business relationships and achieve synergies by ensuring that all parties have a vested interest in success and put in their best efforts.