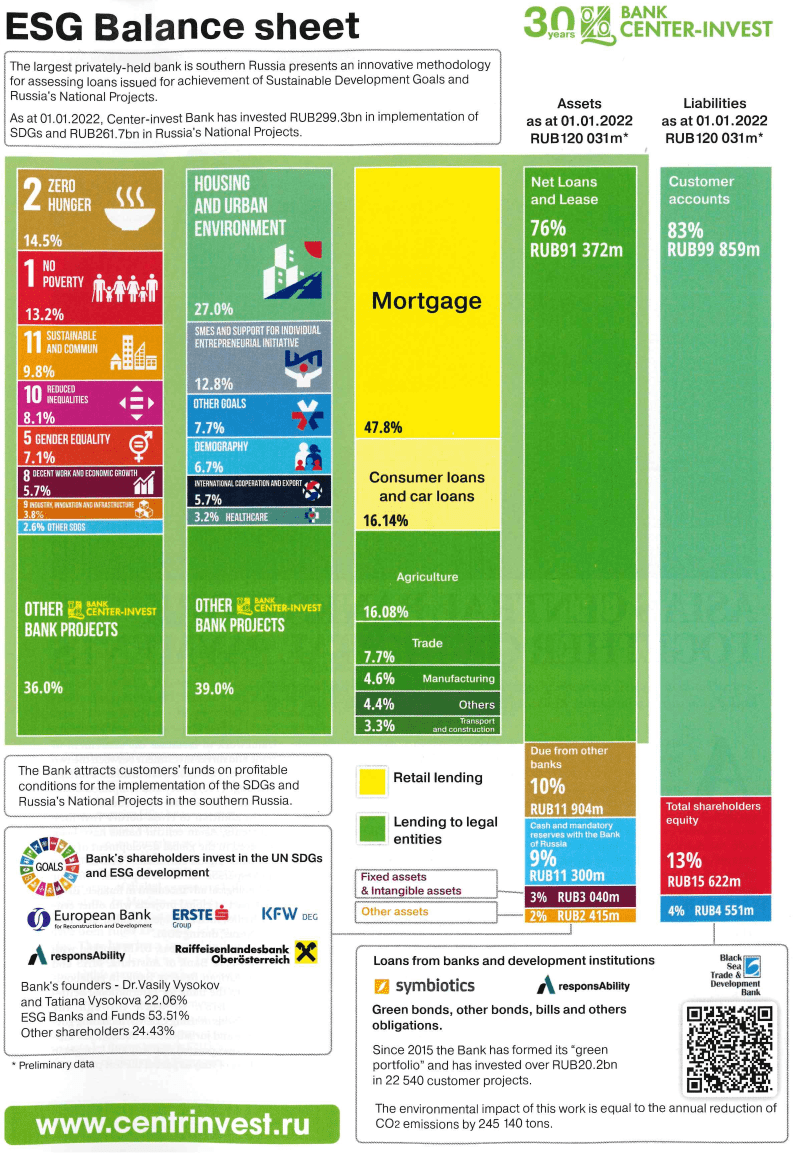

The February edition of The Banker magazine includes its annual analysis of Russian banks. This year The Banker has also published Center-invest Bank’s ESG balance sheet for 2021 (preliminary results). Center-invest Bank was the first bank in the world to produce an ESG balance sheet.

The ESG balance sheet presented below shows very clearly how Center-invest

Bank is transforming its customers’ funds through its loan portfolio to achieve the Sustainable Development Goals (SDGs)

and Russia’s National Projects.

Over 80% of the bank’s funding is from customer accounts, and this money is transformed to help achieve SDGs: Goal 2 Zero Hunger (15% of the loan portfolio), Goal 1 No Poverty (13%), Goal 11 Sustainable Cities and Communities (10%), Goal 10 Reduced Inequalities (8%), Goal 5 Gender Equality (7%), Goal 8 Decent Work and Economic Growth (6%), and Goal 9 Industry, Innovation and Infrastructure (4%).

Center-invest Bank is actively involved in implementation of Russia’s National Projects: Housing and Urban Environment (27% of the loan portfolio), Small and Medium-Sized Enterprises (13%), Demography (7%), and International Cooperation and Exports (6%).

The bank is helping to achieve the SDGs and the National Projects through lending to the real economy (76% of assets), including mortgages (48% of the loan portfolio), retail lending (16%), agribusiness (16%), trade (8%), industry (5%), and transport and communications (3%). The bank transforms traditional financial indicators into a taxonomy based on the SDGs and the National Projects by using analysis of loan purpose and the International Standard Industrial Classification of All Economic Activities (ISIC).

Among Russian banks, The Banker ranks Center-invest Bank (based on 2020 performance) 45th for Tier 1 capital, 38th for assets, 34th for earnings before tax, 41st for capital adequacy, 24th for return on equity and 27th for return on assets.

Center-invest Bank’s relatively close positions in the rating reflect the advantages of its ESG banking business model, achieving a balance between capital adequacy and profitability despite the Covid 19 pandemic.